Credit score ranges and what they mean

Credit scores are an indispensable measurement of your financial health and creditworthiness, and in today’s world you can’t avoid them. The minute you apply for a credit card or submit your information to a mortgage lender or bank, you are agreeing to financial scrutiny in the form of both a credit report and a corresponding credit score. Depending on where you get ranked, you can either be treated to some of the most attractive rates on the market or denied a loan entirely. Scores matter.

While some individuals may feel uneasy at the prospect of fintech software dissecting and assessing their entire credit history, they should take comfort in the notion that this is all done to create a fair and transparent playing field for both the consumer and the lender. If you’ve made sure to pay bills on time and keep credit utilization under control, you may be in for a pleasant surprise when you check your credit score. Conversely, if you have neglected payments and exceeded card limits, then your score will be lower. But with a clear, disciplined approach, you can take steps toward rehabilitating your credit over time.

At the end of the day, your personal credit score is what moves the needle; and yet, despite increased access to scores online, many people are still confused about its implications in everyday life. To help demystify the sprawling world of modern credit scores and their effects on your ability to borrow money and fund mortgages, let’s take a deeper look at credit score ranges, what they mean for you, and how to ensure you’re doing all you can to create sound financial habits.

A brief history of credit scores and credit reports

While credit reports and credit scores are both hugely important instruments in determining your financial reputation with lenders and other entities, it’s your credit score that’s used as an instant indicator of risk or reliability. However, while your credit report does not contain an actual score, it does contain the information that is used to create it.

You may not have realized it at the time, but ever since you first signed up for a credit card or made your initial monthly payment to your cell phone carrier, you’ve been slowly but surely establishing credit. And this hasn’t gone unnoticed by the big three credit bureaus: Experian, TransUnion and Equifax. They’ve collected information on you from various creditors and rolled it into reports that can be purchased by interested parties.

But that’s just part of the story. In an effort to create a more condensed and impartial scoring system that would capture the full scope of credit behavior over time, someone had the novel idea to create a rating system. The idea was to offer lenders a numerical expression of individuals’ creditworthiness based on several key factors, including:

- Payment history

- Amount owed (credit utilization)

- Credit file age

- Account variety

- Applications of new credit

Working with the three credit bureaus, a company called the Fair Isaac Corporation developed a three-digit rating system to encapsulate and define reliability and risk for future lenders. This is your credit score and it typically exists on a range between 300-850. The most commonly used credit score is the FICO score, although there are others, including the VantageScore, which was developed by the big three credit bureaus themselves. The FICO remains the industry leader, however, with an estimated 90% usage rate.

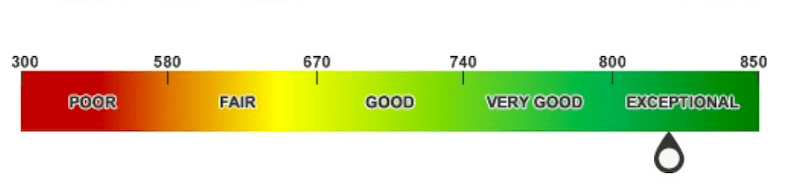

Credit score range chart

In coordination with the Fair Isaac Corporation, Experian, TransUnion and Equifax all employ slightly different algorithms to determine your credit score. Additionally, they have access to different information from your creditors. Together, these factors produce credit scores that will inevitably vary.

Variances aside, it’s important to not only know your specific score, but also the range it falls into. For the year ending 2020, the average credit score in the U.S. was 710, which is considered Good by most scoring models. This score is up 21% over a 10-year period, and can be primarily attributable to improved spending habits and the fact that Americans are paying back their credit card debt on time.

The citizens of Minnesota have the highest overall score at 739 while Mississippians had the lowest at 675. All together, roughly two-thirds of Americans have Good, Very Good or Exceptional credit scores, which is spectacular news. With increased credit education and credit monitoring and a willingness to pay down debt on time, more and more individuals are taking the necessary steps to enhance their financial reputation.

For a better understanding of the different credit score ranges, let’s take a look at the credit score chart from TransUnion.

- <580 = Poor

- 580-669 = Fair

- 670-739 = Good

- 740-799 = Very Good

- 800-850 = Exceptional

<580 = Poor

Individuals who receive a score below 580 possess below-average credit and fewer options for financing. If your score is in this range, you will almost certainly be seen as a credit risk to lenders, resulting in loans that are denied and credit card applications that are not approved. While a poor rating is indeed troublesome, there are actions you can take to slowly rebuild trust with creditors and ultimately increase your score. Financial discipline will be necessary.

580-669 = Fair

While ths score demonstrates some creditworthiness, it’s fair to average at best. However, there are certain financial institutions who will approve loans to applicants in this range with some provisions. For example, a higher down payment may be requested when it comes to applying for a mortgage.

670-739 = Good

Welcome to good credit. You still won’t be eligible for the best mortgage rates or 0% down credit card offers, but a score over 670 ensures access to a modest array of financing options.

740-799 = Very good

This range signals an above average score. By all indications, you’ve maintained low credit utilization, paid your debts on time and have an established credit history over a period of years, with very few newly opened accounts. Your score tells lenders you are a low-risk borrower.

800-850 = Exceptional

If your score is above 800, then you’ve clearly demonstrated excellent financial behavior over a long period of time. Individuals who score in this range can generally expect to be easily approved for credit cards and receive the most attractive loans at reduced rates with the lowest available fees.

Good credit habits to initiate and maintain

Now that you know your credit score and the range it falls into, let’s take a brief moment to explore the kind of healthy financial habits that lead to good credit and the improved financing and lending terms that accompany it:*

- Timely payments

- Organization organization organization

- Only use the credit you really need

- Total length of credit history

- Instill a proactive approach to credit and personal finances

Timely payments

The importance of paying bills on time--whether it’s your mortgage, car payment or credit card bill—can’t be overstated. You always want to pay the minimum monthly payment on time, and if you miss a payment, you want to try to repay it as soon as possible. Negative events like missed payments are hugely detrimental to credit scores. And the more they happen, the worse it is for your credit. Demonstrate financial discipline by only purchasing things you can actually afford and pay down in monthly installments.

Organization organization organization

Often, people are intimidated by the world of finance and credit, and don’t always know the best steps to take to achieve a better credit score or even understand the power of sound financial habits. It all starts with getting organized. You need to keep track of bills, know when payments are due, understand your credit limits, have constant visibility into balances and always have updated knowledge of your credit score. You should also be checking your free credit report from time to time to ensure there are no inaccuracies. If you find errors, dispute them immediately (but politely).

Only use the credit you really need

Just because you have three credit cards, that doesn’t mean it’s wise for you to max them out every month, even if you’re making the monthly payments on time. The credit bureaus frown on individuals using too much of their available credit; although they do like to see a diversity of credit accounts—mortgages, auto loans, credit cards, installment accounts—managed responsibly. Solution: Go easy on the credit. Make a determined effort to not use more than 10% of your total available credit. Your credit score will thank you.

Total length of credit history

A good credit score is amassed over a period of years—the longer, the better. The credit bureaus like to see a track record of you managing your payments; they also factor in things like average age of all accounts. A slim credit history is not ideal, but as long as your financial habits are healthy, it’s not a huge impediment. But nothing happens overnight. In the meantime, demonstrate to lenders your growing financial maturity by not having too many debts and paying off the ones you do have in a consistent, timely fashion.

Instill a proactive approach to credit and personal finances

Because credit scores have such a tremendous sway over future borrowing opportunities, you want to start prioritizing the good habits that result in good credit at a young age, and maintain those good habits throughout the ensuing years. If you miss a payment or forget to pay a bill one month, don’t fall into a stupor of disappointment. Be proactive. Sometimes a polite phone call immediately placed to a lender can stave off a red flag. Be your own master of motivation. Tell yourself that you will achieve exceptional credit and then start making it happen. Contest inaccuracies, pay down loans in a timely manner, and make sure you have an updated understanding of your credit score and your credit range.

In conclusion

Your relationship with credit is one of the most important relationships you’ll have throughout your life. Your credit score tells the world how well you handle money and understand the importance of building sound credit over a period of years.

When it comes to securing a mortgage, a credit score that falls into the commonly acknowledged ranges of Good, Very Good and Exceptional will almost always open doors for you when it comes to loan eligibility and attractive rates. But depending on your financial behavior, credit scores can change quite dramatically from month to month and certainly from year to year. That’s why it’s always prudent to regularly check your score and adjust your habits as need be. If knowledge is power, then continually updated knowledge is especially powerful in the context of personal finances.

*PROPER RATE IS NOT A CREDIT REPAIR COMPANY, CREDIT REPORTING AGENCY, BROKER OR ADVISOR. You acknowledge that Proper Rate is not a credit repair company or similarly regulated organization under applicable laws, and does not provide credit repair services. Where available, recommendations, tips and education materials are provided to you at no additional charge, and for educational purposes only. The services are intended to provide you with general information and assist you with identifying your options. The information is provided only to enable you to make your own choices about your personal finance, and is not intended to provide, legal, tax or financial advice. We do not provide any services to repair or improve your credit profile or score, nor do we provide any representation that the information we provide will actually repair or improve your profile. Consult the services of a competent professional when you need any type of assistance. You acknowledge that Proper Rate is not a “consumer reporting agency” as that term is defined in the Fair Credit Reporting Act as amended.

Powered by Froala Editor